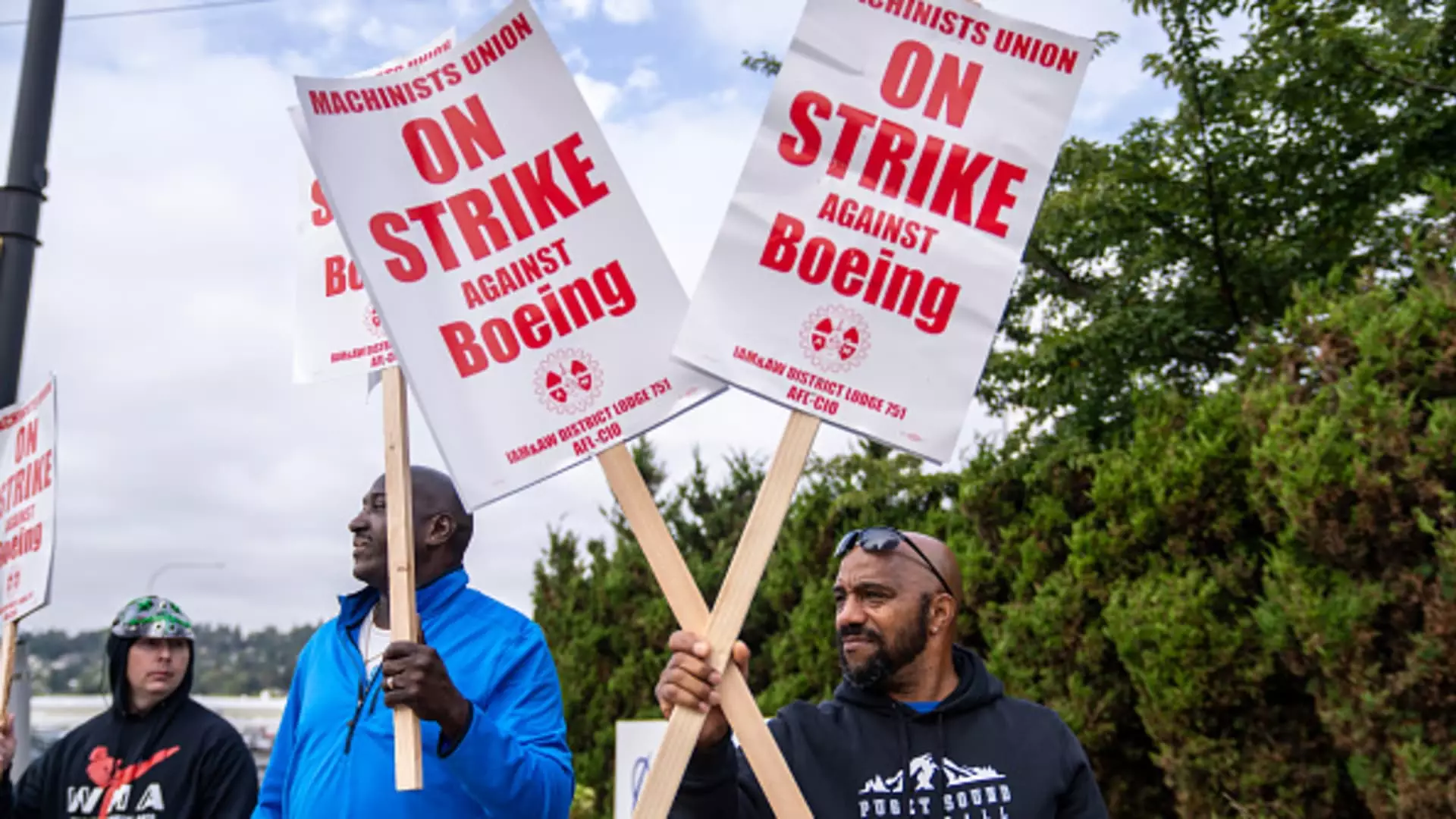

The Boeing Company has long been a pillar of the aerospace industry, yet recent events have revealed significant vulnerabilities. Over 30,000 machinists initiated a strike just over a month ago after rejecting a tentative contract, highlighting ongoing tensions between labor and management. This standoff is not merely a labor dispute; it symbolizes Boeing’s broader challenges as it grapples with production halts, financial instability, and diminished stakeholder confidence. As tensions rise, the repercussions become evident, affecting not just the company but the entire aerospace supply chain.

Boeing’s precarious situation is further compounded by estimates from S&P Global Ratings, which indicate that the strike is costing the company over $1 billion monthly. This staggering figure reflects not only direct losses from halted production but also the cascading effects on supplier relationships and market share. The strike has idled factories across the Seattle region, hampering Boeing’s ability to meet delivery schedules for their aircraft models, notably the 737 Max, which has already faced its own crisis due to past safety concerns.

In addition to production issues, Boeing recently announced a plan to cut its global workforce by 10%, which includes the layoff of executives and support staff. This move may be seen as a short-term solution to mitigate financial losses; however, it raises fundamental questions about the company’s long-term strategy. The urgency of these cuts suggests Boeing is not only battling the strike but also a looming financial crisis exacerbated by delayed deliveries and ongoing operational inefficiencies.

Union Dynamics and Negotiation Challenges

Central to the ongoing strike are the negotiations between Boeing and the International Association of Machinists and Aerospace Workers (IAM). Despite initial optimism from Boeing’s management regarding potential agreements with union representatives, the overwhelming rejection of the contract proposal—a 95% no-vote—reveals deep-rooted dissatisfaction among workers. Union leaders are pushing for resolutions that prioritize workers’ needs, including a return to a pension plan, although experts like Professor Harry Katz suggest this may be an unrealistic demand.

Complicating negotiations, Boeing recently filed an unfair labor practice charge against the union, alleging bad faith negotiations. This tactic could further entrench positions and create a stalemate that prolongs the strike. The union’s leadership, however, seems intent on fostering a more collaborative relationship with management, urging Boeing’s CEO, Kelly Ortberg, to pursue a more constructive dialogue rather than temporal threats and coercive tactics.

As the newly appointed CEO, Kelly Ortberg faces a daunting task. With Boeing’s stock plummeting 42% in 2023 and the company struggling to achieve profitability since 2018, Ortberg must navigate a complex web of labor relations, production challenges, and financial performance. His impending first earnings call is an opportunity to instill confidence in investors, yet the scrutiny will be intense, given the circumstances.

In his communications, Ortberg has emphasized the need for a strategic focus on core competencies while avoiding overextension. However, continual disruptions such as the strike could thwart these efforts, potentially harming investor relations and stifling innovation. The paradox remains: uhile Ortberg aims to streamline operations, the simultaneous reduction of workforce may hinder the very production stability he seeks to achieve.

Sustaining an Ecosystem in Crisis

The implications of Boeing’s ongoing struggles extend beyond its walls to the broader aerospace supply chain. For instance, Spirit AeroSystems, a key supplier and manufacturer of the 737 fuselage, has signaled potential furloughs in light of Boeing’s operational uncertainties. The ripple effects of labor disruptions and production halts can diminish the resilience of dozens of suppliers and subcontractors that rely on Boeing’s output for their economic viability.

In this context, it’s critical for Boeing to reassess not only its internal strategies but also its relationships with suppliers. Building a resilient ecosystem requires transparency and collaboration rather than a unilateral approach that could alienate key partners. Instability at Boeing could drive these suppliers to make significant cuts or shifts in operations, creating a broader landscape of uncertainty across the aerospace sector.

Boeing stands at a crossroads, challenged by internal labor strife, external market pressures, and a significant operational overhaul that appears necessary to regain public and investor trust. The ongoing strike is emblematic of broader issues within the company that require decisive leadership and strategic foresight. As Ortberg navigates through this tumultuous period, Boeing’s future hinges on balancing stakeholder interests while restoring stability to its operations. Without meaningful engagement with its workforce and a clear, coherent strategy, Boeing risks falling deeper into a cycle of crises that could threaten its once-storied legacy in the aerospace industry.

Leave a Reply