The aviation industry is currently facing challenges with parts and labor shortages, delayed deliveries of new airplanes, engine recalls, and premature repairs. These issues have created a backlog for aircraft engine shops around the world. The demand for repairs and overhauls has significantly increased from a $31 billion business before the pandemic to $58 billion this year. The industry giants like Boeing and Airbus are struggling to keep up with the supply chain demands, leading to delays in deliveries and increased pressure on airlines to maintain their fleets.

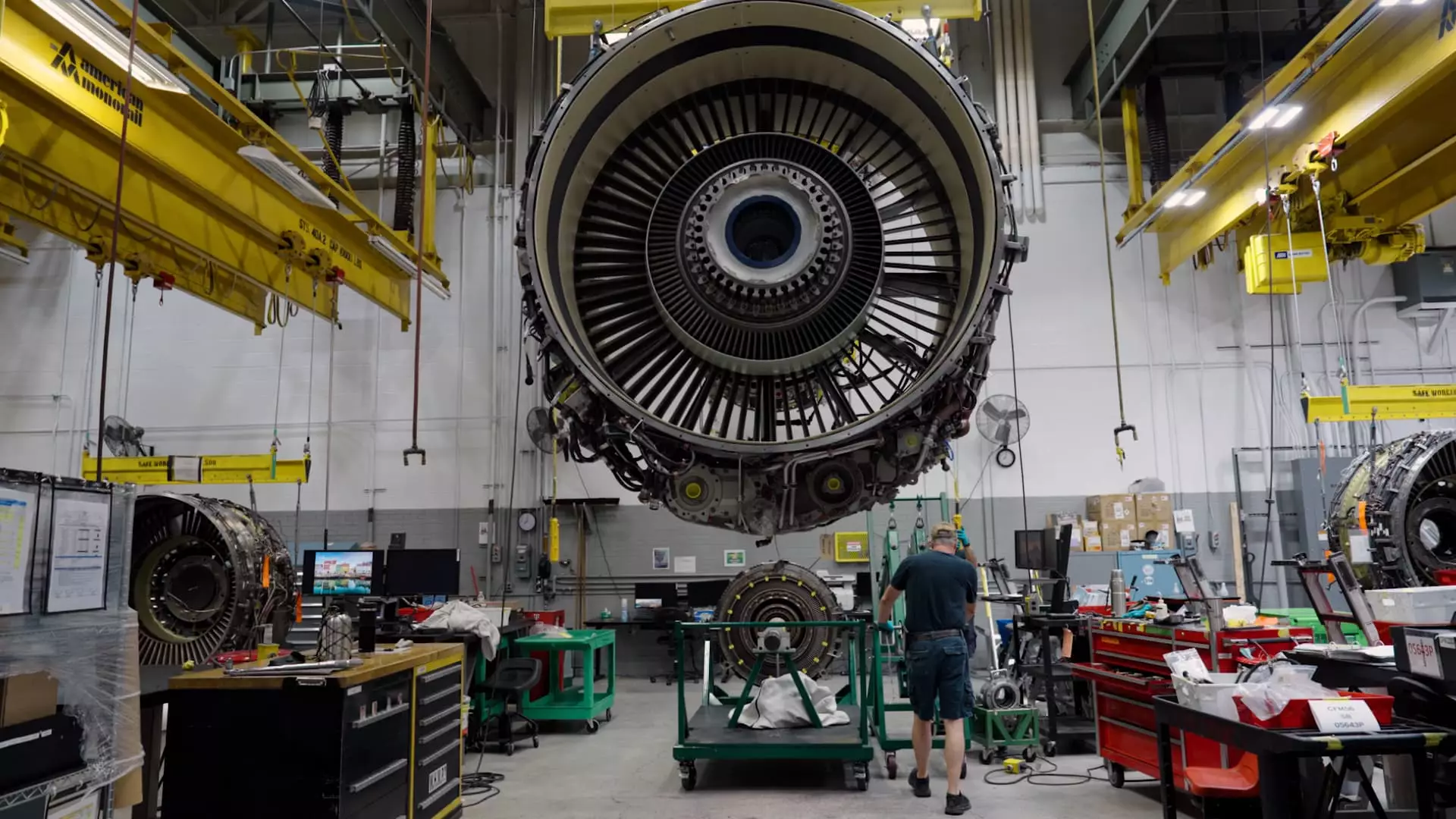

American Airlines has taken a proactive approach to the situation by expanding its in-house engine shop in Tulsa. By increasing its overhauls by roughly 60% and adding more jobs and equipment, American Airlines aims to have better control over the maintenance process. This decision has allowed them to streamline the repair process, with a focus on CFM56 engines used in their older Boeing 737 and Airbus A320 aircraft. By being able to overhaul engines in less than 60 days compared to 120-200 days at outside shops, American Airlines has gained a competitive advantage in fleet maintenance.

The cost of engine overhauls is significant, with each overhaul costing up to $5 million for narrow-body airplanes and double that for wide-body aircraft. The challenges lie in finding flawless, costly parts like engine compressor blades, which can go for $30,000 each. Additionally, newer engines with advanced technologies are entering repair shops earlier than expected, adding to the frustration of airline CEOs who are struggling to cope with the demand for maintenance and overhauls.

Both Airbus and Boeing are facing supply chain disruptions, leading to delays in new airplane deliveries. This has forced airlines to extend the lifespan of their older aircraft, increasing the need for routine maintenance and overhauls. Pratt & Whitney’s engine recall has further complicated the situation, prompting airlines like JetBlue Airways and Spirit Airlines to defer new jet deliveries to mitigate costs. The high demand for engine overhauls has been lucrative for engine suppliers, who make billions from maintaining and repairing engines.

GE Aerospace, a major player in the engine maintenance sector, has invested $1 billion to upgrade its engine shops worldwide. The aftermarket business for engine maintenance is a significant revenue source for companies like GE Aerospace, with engine maintenance making up 65% of its revenue. Rental rates for engines have skyrocketed due to the high demand, making it difficult for airlines to find alternatives to costly overhauls. Leasing firms have been acquiring spare engines to meet the rising demand.

Looking ahead, the challenges in the aircraft engine repair and overhaul industry are likely to persist for the next few years. With airlines struggling to keep up with the demand for maintenance and overhauls, there is a growing need for streamlining processes and investing in infrastructure to support the industry. As supply chain issues continue to impact new airplane deliveries, airlines will have to find innovative solutions to manage their fleets effectively and ensure passenger safety and satisfaction.